Tax Brackets 2025: What American Taxpayers Need to Know

As we move into 2025, it’s crucial for American taxpayers to familiarize themselves with the new tax brackets and changes that will impact their finances. The Internal Revenue Service (IRS) has announced adjustments to the federal income tax brackets for 2025, reflecting inflation and other economic factors. These changes are designed to ensure that taxpayers are not unfairly pushed into higher tax brackets due to inflation, a phenomenon known as “bracket creep.”

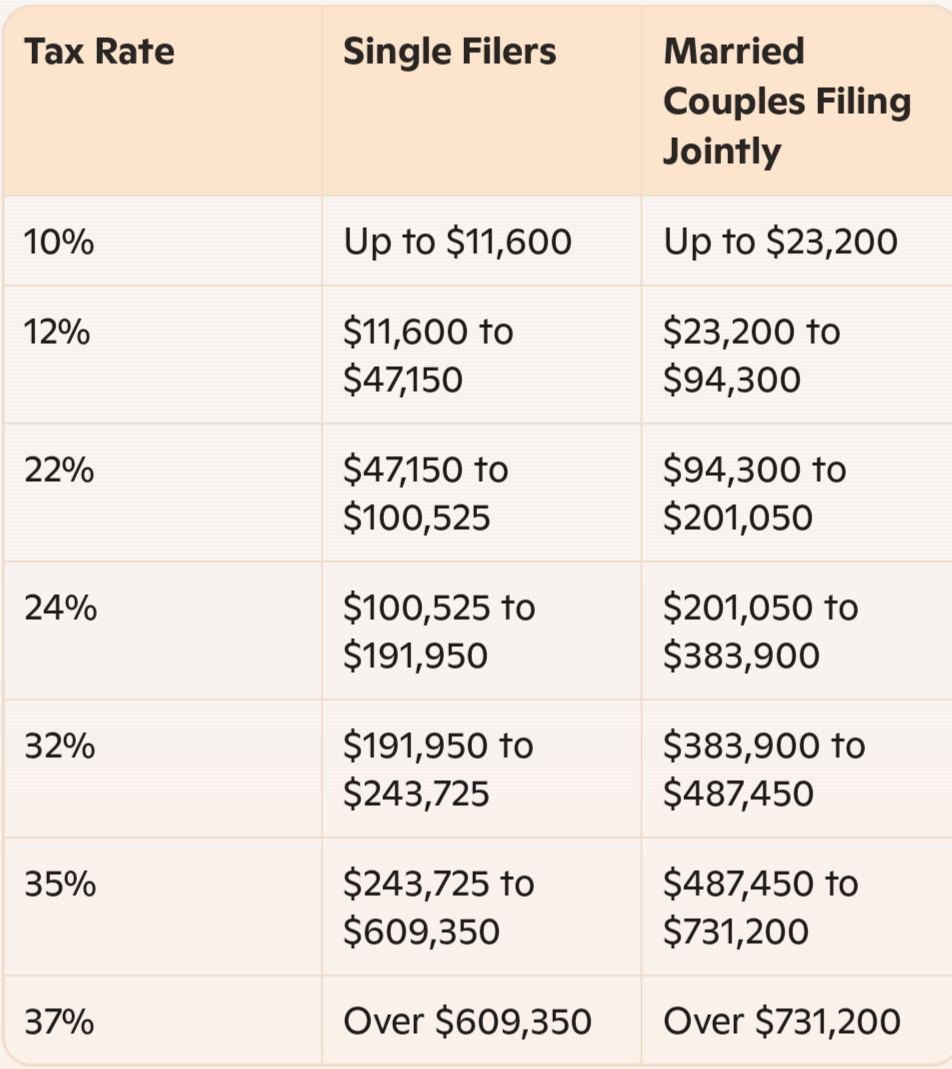

New Tax Brackets for 2025

The federal income tax system in the United States is progressive, meaning that the tax rate increases as income rises. For 2025, there are seven tax brackets with the following income thresholds for single filers and married couples filing jointly:

Standard Deduction and Other Adjustments

In addition to the new tax brackets, the IRS has also adjusted the standard deduction for 2025. The standard deduction is a fixed amount that reduces the income on which you are taxed, and it has increased to account for inflation. For 2025, the standard deduction amounts are as follows:

•Single filers and married individuals filing separately: $14,600 (up $750 from 2023)

•Married couples filing jointly: $29,200 (up $1,500 from 2023)

•Head of household: $21,900 (up $1,100 from 2023)

These adjustments are intended to help taxpayers keep pace with the rising cost of living and ensure that their purchasing power is not eroded by inflation.

Impact on Taxpayers

The new tax brackets and standard deduction adjustments will have a significant impact on taxpayers across the country. For many, the increased standard deduction will result in lower taxable income and potentially lower tax liability. However, taxpayers in higher income brackets may see an increase in their tax rates, which could lead to higher tax bills.

It’s important for taxpayers to review their financial situation and consult with a tax professional to understand how these changes will affect their individual circumstances. By staying informed and planning ahead, taxpayers can make informed decisions and take advantage of any available tax benefits.

Strategies for Tax Planning

To navigate the new tax brackets and make the most of the available deductions and credits, taxpayers can consider several strategies:

1.Maximize Deductions:

•Take advantage of all available deductions, such as charitable contributions, medical expenses, and mortgage interest.

•Keep thorough records of all deductible expenses to ensure you can substantiate them if needed.

2.Contribute to Retirement Accounts:

•Contributions to retirement accounts like IRAs and 401(k)s can reduce taxable income and provide long-term financial benefits.

•Consider making the maximum allowable contributions to take full advantage of tax-deferred growth.

3.Invest in Tax-Advantaged Accounts:

•Consider investing in accounts like Health Savings Accounts (HSAs) and Education Savings Accounts (ESAs) that offer tax benefits.

•HSAs, for example, allow for tax-free contributions, growth, and withdrawals for qualified medical expenses.

4.Consult a Tax Professional:

•Seek advice from a tax professional to ensure that you are taking advantage of all available tax benefits and complying with the latest tax laws.

•A tax professional can provide personalized guidance based on your specific financial situation.

Detailed Insights on 2025 Tax Changes

Individual Taxpayer Adjustments

For individual taxpayers, the adjustments in tax brackets and standard deductions are designed to reflect changes in the cost of living. This means that taxpayers may see different withholding amounts on their paychecks, which could impact their overall tax liability. The changes also aim to prevent bracket creep, ensuring that inflation does not push taxpayers into higher tax brackets unfairly.

Changes for Businesses and Corporations

Businesses and corporations also face changes in tax rates and deductions. The corporate tax rate remains a focal point of economic discussions, with potential adjustments aimed at encouraging investment and job creation. Small businesses, in particular, need to stay informed about changes to tax credits and deductions that can impact their bottom line.

Estate and Gift Tax Adjustments

The estate and gift tax exemptions have also been adjusted for 2025, reflecting inflationary changes. These adjustments can have significant implications for estate planning and wealth transfer strategies. Taxpayers should review their estate plans to ensure they take full advantage of the available exemptions and minimize potential tax liabilities.

Read also:Top movies and TV shows of 2024

Tax Credits and Their Impact

Tax credits are another important aspect of tax planning, as they directly reduce the amount of tax owed. For 2025, several tax credits have been adjusted or introduced to provide additional relief to taxpayers:

1.Child Tax Credit:

•The Child Tax Credit provides significant financial relief to families with children. For 2025, the credit amount remains substantial, providing up to $2,000 per qualifying child.

•Additional credits may be available for dependent children under certain income thresholds, making it important for eligible families to claim these benefits.

2.Earned Income Tax Credit (EITC):

•The EITC benefits low- to moderate-income working individuals and families, with the maximum credit amount adjusted annually for inflation.

•The income limits and credit amounts for 2025 have been updated, making it essential for eligible taxpayers to review their eligibility and claim the credit.

3.Education Credits:

•The American Opportunity Credit and Lifetime Learning Credit provide tax relief for higher education expenses. These credits can reduce the financial burden of tuition and related costs.

•Taxpayers should ensure they meet the eligibility requirements and keep accurate records of education expenses to claim these credits.

4.Energy Efficiency Credits:

•Taxpayers who make energy-efficient home improvements may qualify for credits that help offset the cost of these upgrades.

•The specifics of these credits can vary, so it’s important to review the latest guidelines and ensure compliance with eligibility criteria.

Tax Planning for Retirement

Retirement planning is a crucial aspect of managing tax liability, especially with the changes in tax brackets and deductions. Here are some key strategies for tax-efficient retirement planning:

1.Maximize Contributions to Retirement Accounts:

•Contributions to traditional IRAs and 401(k)s reduce taxable income and grow tax-deferred until withdrawn.

•Roth IRAs, while funded with after-tax dollars, offer tax-free growth and withdrawals, providing tax diversification in retirement.

2.Consider Roth Conversions:

•Converting traditional IRA or 401(k) funds to a Roth IRA can provide tax-free growth and withdrawals in the future.

•Timing and tax implications should be carefully considered, as the conversion amount is taxable in the year of the conversion.

3.Plan for Required Minimum Distributions (RMDs):

•RMDs are mandatory withdrawals from retirement accounts starting at age 72, and failing to take them can result in significant penalties.

•Effective planning can help manage the tax impact of RMDs and ensure compliance with IRS regulations.

4.Utilize Catch-Up Contributions:

•Taxpayers aged 50 and older can make additional “catch-up” contributions to their retirement accounts, increasing their retirement savings potential.

•These contributions provide an opportunity to save more while reducing current taxable income.

Estate Planning Considerations

The adjustments to estate and gift tax exemptions for 2025 make it essential for taxpayers to review their estate plans. Here are some key considerations for effective estate planning:

1.Review and Update Estate Plans:

•Regularly review and update wills, trusts, and beneficiary designations to reflect current wishes and changes in tax laws.

•Ensure that estate plans take advantage of the increased exemptions and other tax-efficient strategies.

2.Utilize Gifting Strategies:

•Annual gifting allows taxpayers to transfer wealth without incurring gift tax, up to the annual exclusion amount.

•Consider utilizing lifetime gift exemptions to reduce the taxable estate and transfer wealth to heirs tax-efficiently.

3.Consider Trusts for Tax Efficiency:

•Trusts can provide significant tax benefits and help manage the distribution of assets according to specific wishes.

• Irrevocable trusts, charitable remainder trusts, and other trust arrangements offer various tax planning opportunities.

4.Plan for Estate Tax Liabilities:

•Calculate potential estate tax liabilities and consider strategies to minimize the tax burden on heirs.

•Life insurance policies can be used to provide liquidity to pay estate taxes and preserve the value of the estate for beneficiaries.

Staying Informed and Proactive

As tax laws continue to evolve, staying informed and proactive is key to effective tax planning. Here are some steps taxpayers can take to stay ahead of changes:

1.Stay Updated on Tax Law Changes:

•Regularly review IRS announcements and updates to ensure compliance with the latest tax laws.

•Subscribe to reputable tax publications and resources for timely information and insights

1 thought on “Tax Brackets 2025: What American Taxpayers Need to Know”

Comments are closed.